Table of Contents

Introduction

A civilization’s worthiness can be judged by the standing of women in that period. From the Vedic time, the status of women in Indian society has always been considered secondary to that of men. Hindu women have suffered inequality in terms of rights related to their inheritance throughout history. Under the present legal system of India, people from different religions are governed by their personal laws in matters of inheritance, marriage, separation, guardianship, etc. Many societal issues are developed from personal religious laws along with gender inequality.

The presence of various religious laws is being described increasingly as legal diversity. In this context, the inheritance of property amongst Hindus, Sikhs, Jains, and Buddhists, is governed by the Hindu Succession Act, 1956 [“Act”]. A peculiar factor of this Act is that it makes a differentiation between the intestate succession of females and males. The female intestate succession is further differentiated depending upon the source of the property. This kind of differentiation, depending upon the source of property and gender, is not seen in any other religion across the world.[1] Therefore, through this article, the Author will try to explore the relevant statutory provisions, along with key judicial interpretations, and offer a comparative analysis of female intestate succession to provide a comprehensive understanding of the subject.

Understanding the Hindu Succession Act, 1956

The Hindu Succession Act, 1956, marks a significant milestone in Indian family law, particularly concerning the inheritance rights of women. It is based on the Mitakshara principle of propinquity which prioritizes heirs based on their proximity of relationship to the deceased. Before this Act, the principles of succession were inconsistent, varying across different schools of Hindu law, such as Mitakshara and Dayabhaga. It provides a single code for succession and replaces any customs previously governing the inheritance rights of Hindus.

The primary objective of this Act was to reform and codify the law relating to intestate succession among Hindus. It aimed to provide a uniform system of inheritance, removing distinctions previously made on the basis of sex. This was a significant step towards gender equality in property rights, as it recognized women’s right to inherit property on par with men.

Devolution of Property when a female dies intestate

Section 15 of the Act outlines the order of succession for a female Hindu who died intestate. This section, along with Section 16, forms the cornerstone of female intestate succession under Hindu law. The property of a female Hindu who dies without leaving a will devolves according to a specific order of preference among heirs.

Section 15(1): General Rules of Succession

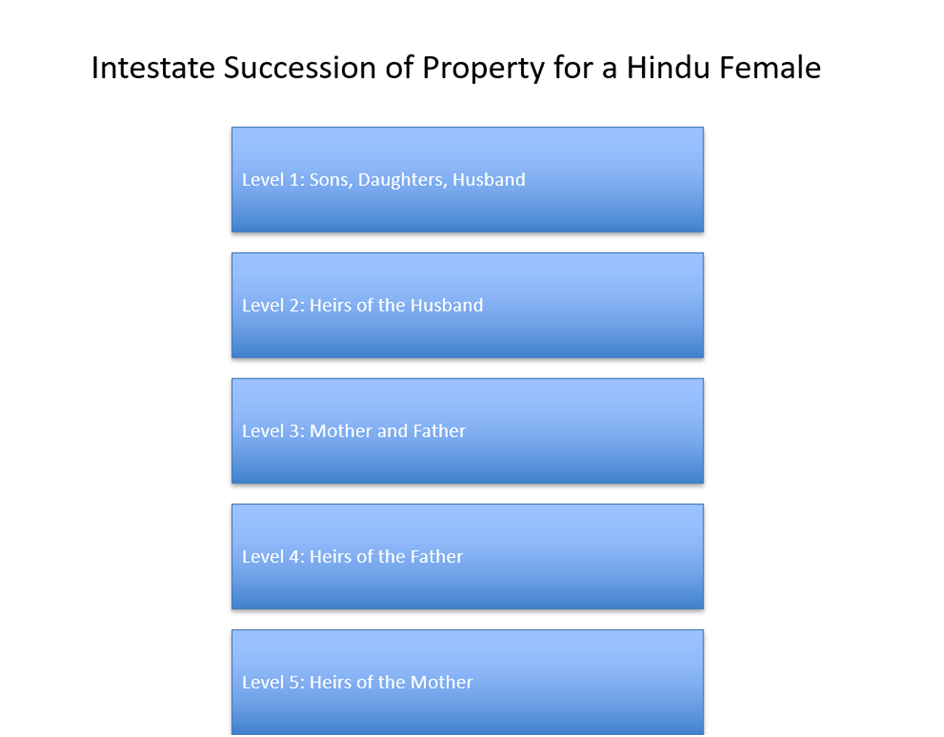

Section 15 of the Hindu Succession Act outlines a detailed and uniform scheme for the devolution of a female Hindu’s property who dies intestate. The property devolves in the following order:

- Sons, daughters, (including the children of any predeceased son or daughter), and husband;

- Heirs of the husband;

- Mother and father;

- Heirs of the father;

- Heirs of the mother.

Section 15(2): Exception to the General Rule

Section 15(2) provides two critical exceptions:

- Property inherited from the father or mother: If the female dies without issue, this property will revert to the heirs of the father rather than follow the general order of succession.

- Property inherited from the husband or father-in-law: In the absence of an issue, this property will devolve upon the heirs of the husband.

These exceptions ensure that property returns to the original source from which it was inherited, maintaining the lineage of property ownership.

Section 16: Order of Succession and Distribution

Section 16 of the Act complements Section 15 by providing rules for the order of succession and computation of shares among heirs. It stipulates that heirs mentioned in a prior entry of Section 15 are preferred over those in subsequent entries. Moreover, heirs included in the same entry succeed simultaneously. An important aspect of this section is the provision for children of predeceased children, who inherit per stirpes, taking the share their parents would have received if alive at the time of the intestate’s death.

Devolution of Property from Self-earned Income

The law is silent on the self-acquired property of a Hindu female. Section 15(1) only deals with ‘general property’ and apart from the exceptions specified in Section 15(2), it does not make any distinction between a self-acquired property and the property which she inherited from any other relation. Thus, if a female inherits property through her own income, the devolution of such property follows the general rules under Section 15.[2] However, this scenario may require further legal analysis depending on the specifics of the case and the applicable jurisdiction.

Judicial View

The interpretation and application of these sections have been further clarified through various judicial pronouncements. In one of the most recent cases titled Arunachala Gounder (dead) by Lrs. v. Ponnusamy and Ors.,[3] the Supreme Court of India discussed the ancient rules of inheritance and the legislative intent behind the Hindu Succession Act. The judgment emphasized that the property of a female Hindu dying intestate should primarily devolve upon her own heirs, and in the absence of direct heirs, it should revert to the source.

Another significant case is Lachman Singh v. Kirpa Singh & Ors.[4] which provided insights into the interpretation of terms like ‘sons’ and ‘step-sons’ under the Act. In this, the Apex Court clarified that the term ‘sons’ includes sons born out of the womb of a female by the same husband or different husbands, including illegitimate sons. However, it does not include step-sons unless explicitly stated. This interpretation broadens the scope of inheritance rights while maintaining clarity on who qualifies as a legal heir.

Comparative Analysis

The Act, through its Sections 8 and 9 read with Schedule to the Act, also provides for the devolution of property in the case of males dying intestate. The key differences include:

- The property of a male Hindu devolves primarily upon his heirs, including son(s), daughter(s), and widow, followed by agnates and cognates.

- The property inherited by a male from his parents reverts to the father’s heirs in the absence of direct descendants.

The rules of succession for males and females under the Hindu Succession Act are significantly different. While male succession follows a straightforward pattern primarily involving sons, daughters, and the widow, female succession introduces complexities due to the involvement of properties inherited from different sources, such as her father, mother, or husband. This distinction underlines the patriarchal influences inherent in traditional Hindu law, where the property is often expected to return to the original male lineage.

Conclusion

The Hindu Succession Act, 1956, provides a structured yet complex framework for the devolution of property when a female dies intestate. Understanding these rules is essential for ensuring that the inheritance rights of female Hindus are respected and upheld. The provisions in Sections 15 and 16, coupled with judicial interpretations, provide clear guidance on how property should be distributed in these cases.

The Act’s approach to female intestate succession also reflects changing societal norms and the recognition of women’s rights to property. By placing sons and daughters on an equal footing in the order of succession, the Act promotes gender equality in inheritance matters. Furthermore, the inclusion of the husband as a primary heir acknowledges the marital relationship’s significance in property matters. However, the complexities and exceptions outlined in the Act highlight the need for continuous legal reform to address gender biases and ensure that inheritance laws evolve to reflect contemporary societal values. The existing legal framework still reflects a traditional mindset, particularly concerning the treatment of property inherited from male relatives, which often overshadows the female’s independent rights.

This article is authored by Mr. Aakash Dubey, student at Amity University, Raipur, Chhattisgarh.

[1] Mohammed Jaheer S/o Abdul Rehman & Ors. v. M.V. Mohammed Hussain Walayata (since deceased) through LRs. H. Tajunnisa Begum wd/o Mohd. Husain & Ors., (2013) 2 Mah LJ 294.

[2] Omprakash & Ors. v. Radhacharan & Ors., 2009 (15) SCC 66.

[3] (2022) 11 SCC 520.

[4] (1987) 2 SCC 547.

All efforts are made to ensure the accuracy and correctness of the information published at Legally Flawless. However, Legally Flawless shall not be responsible for any errors caused due to oversight or otherwise. The users are advised to check the information themselves.