Table of Contents

Introduction

Real Estate Investment Trusts (REITs) have altered real estate asset access, allowing investors to participate in the lucrative property market without the burden of direct ownership. This novel investment instrument has altered the traditional property investment landscape, providing new potential for development, diversification, and profits. This paradigm shift, however, brings with it a complicated web of legal issues, regulatory challenges, and operational intricacies that must be addressed.

As the Indian real estate sector evolves, REITs have emerged as a key actor, providing investors, developers, and stakeholders with a unique set of benefits and prospects. However, managing the complexities of real estate investment trusts necessitates a thorough understanding of their structure, operation, and governance. This blog will go into the foundations of REITs, their evolution, and the legal concerns that shape their operation in India, providing useful insights for investors, developers, and professionals looking to capitalize on this disruptive trend.

What are Real Estate Investment Trusts (REITs)?

Definition and Concept

Without actually owning any real estate, investors can participate in a diverse portfolio of properties through Real Estate Investment Trusts (REITs). REITs enable investors to profit from income-generating properties such as rentals and sales while maintaining liquidity and transparency. REITs work by merging investor capital to own, administer, and run income-producing properties. They distribute a major amount of their income to shareholders in the form of dividends, ensuring a consistent income stream. REITs are capable of being listed on stock exchanges, making it simple for investors to purchase and sell shares.

Types of REITs

While REITs are classified by the various sorts of properties they invest in, there were originally three broad categories:

- Equity REITs: The majority of REITs are equity-based, which means they own and manage income-producing properties. Renting homes generates more revenue than reselling them.

- Mortgage REITs: Mortgage REITs lend money to real estate owners and operators directly through mortgages and loans, or indirectly through the acquisition of mortgage-backed securities. Their earnings are primarily driven by the net interest margin, which is the difference between the interest they make on mortgage loans and the cost of funding such loans. This model makes them sensitive to interest rate hikes, however equity REITs are also heavily influenced by rate movements.

- Hybrid REITs. These REITs mix strategies from both equity and mortgage REITs.

Structure and Functioning

Real Estate Investment Trusts (REITs) are organized primarily in two ways: as publicly traded companies listed on stock exchanges or as private entities. Both structures involve pooling capital from numerous investors, which is then used to acquire, manage, and operate a diversified portfolio of real estate assets. This collective investment approach allows investors to gain exposure to large-scale real estate projects without directly owning or managing the properties themselves.

Brief History of REITs

The concept of Real Estate Investment Trusts (REITs) was first introduced in the United States in 1960, with the passage of the Real Estate Investment Trust Act. This legislation aimed to provide small investors with access to income-producing real estate, which was previously only available to large institutions and wealthy individuals. The first REIT, National Realty Trust, was listed on the New York Stock Exchange (NYSE) in 1961.

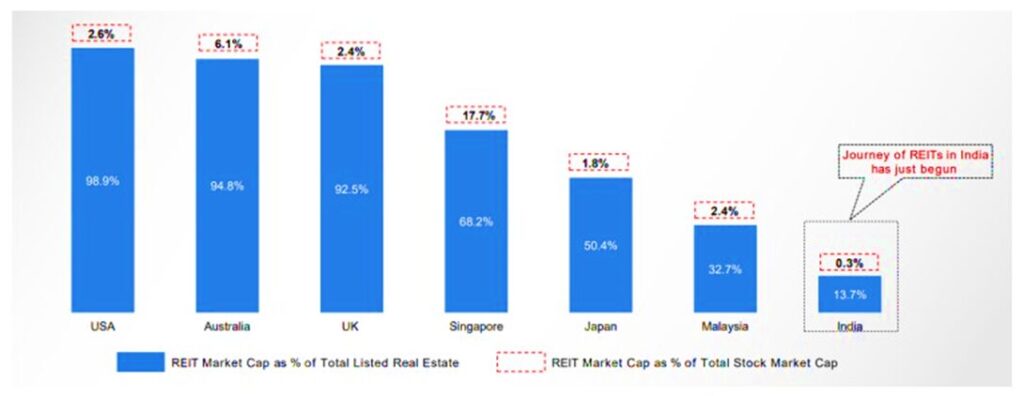

Since then, REITs have expanded globally, adapting to various market conditions and regulatory environments. Today, REITs are listed on major stock exchanges in over 20 countries, including the US, Canada, Australia, and Singapore.

Source:

Indian REITs Association. (2024). IRA REIT Primer

Introduction of REITs in India

India introduced its own REIT framework in 2014, with the Securities and Exchange Board of India (SEBI)[2] establishing REIT regulations. This move aimed to increase liquidity, diversify portfolios, and attract institutional investment into the Indian real estate sector.

SEBI’s REIT regulations provided a framework for the creation and operation of REITs in India, including guidelines for:

- Eligibility criteria for REITs

- Minimum public float requirements

- Disclosure and reporting requirements

- Governance and management structures

- Investment restrictions and diversification requirements

The introduction of REITs in India marked a significant milestone in the country’s real estate sector, providing investors with a regulated, transparent investment vehicle to access income-producing properties. Since then, several REITs have been listed on Indian stock exchanges, including Embassy Office Parks REIT, Mindspace Business Parks REIT, and Brookfield India Real Estate Trust.

Advantages and Opportunities with REITs

Benefits for Investors

- Portfolio Diversification and Liquidity: Real estate investment trusts (REITs) provide portfolio diversification and liquidity, cutting risk and enhancing possible profits. Furthermore, their public listing on stock exchanges gives instant liquidity, allowing you to buy and sell shares as needed.

- Access to Real Estate Investments: Investors can acquire access to gigantic, income-generating real estate holdings with smaller inputs.

- Stable Income and Capital Appreciation: REITs offer both stable income and opportunity for over time capital gains through dividend distributions.

- Transparency and Regulation: REITs follow firm laws and reporting requirements to ensure openness and accountability. This gives investors trust in their investing decisions.

- Affordability: REITs offer an affordable entry point into the real estate market, making it accessible to a broader range of investors.

- Flexibility: REITs can be easily integrated into existing investment portfolios, providing a flexible option for investors seeking to diversify their holdings.

Impact on the Real Estate Market

- Role in Development:

Real Estate Investment Trusts (REITs) play a pivotal role in shaping the real estate landscape, driving development and innovation in both commercial and residential sectors. By providing a steady influx of capital, REITs enable the creation of new projects, breathe new life into existing properties, and foster a vibrant and dynamic market.

- Unlocking Opportunities for Developers

REITs offer developers and large property holders a tantalizing prospect: access to a new, stable source of funding. This injection of capital not only facilitates the development of ambitious projects but also enhances the liquidity of their real estate assets. With REITs, developers can:

- Secure funding for innovative projects, pushing the boundaries of design and functionality

- Revitalize underutilized properties, transforming them into thriving hubs of activity

- Diversify their portfolio, mitigating risk and amplifying returns

- Tap into a vast network of investors, fostering collaboration and growth

By bridging the gap between capital and development, REITs have become an indispensable force in the real estate market, empowering developers to turn their vision into reality.

Legal Framework Governing REITs[3]

SEBI (Real Estate Investment Trusts) Regulations, 2014

The Securities and Exchange Board of India (SEBI) has established a comprehensive framework for Real Estate Investment Trusts (REITs) in India, ensuring transparency, accountability, and investor protection. The SEBI REIT Regulations, 2014, provide the foundation for REITs to operate in the country.

Key Provisions:

1. Registration: REITs must register with SEBI, providing detailed information about their structure, management, and investment plans.[4]

2. Compliance: REITs must adhere to strict compliance requirements, including regular reporting, audits, and disclosure norms.[5]

3. Disclosure: REITs must make timely and accurate disclosures about their financial performance, portfolio, and material events.[6]

Roles and Responsibilities:

1. REIT Managers: Responsible for managing the REIT’s assets, making investment decisions, and ensuring compliance.[7]

2. Trustees: Independent entities that hold the REIT’s assets and ensure the interests of unit holders are protected.[8]

3. Sponsors: Promoters of the REIT, responsible for setting up the trust and ensuring its stability.[9]

Registration and Compliance Checklist:

To register and operate a REIT in India, the following conditions must be met:

1. Minimum Initial Offer Size: ₹500 crore s (approximately $67 million USD)

2. Minimum Public Holding: 25% of the REIT’s units must be held by the public

3. Maximum Leverage: 49% of the REIT’s assets can be financed through debt

4. Diversified Portfolio: The REIT’s assets must be spread across multiple properties and locations to minimize risk

5. Independent Trustee and Manager: The REIT must have an independent trustee and manager to ensure the interests of unit holders are protected

6. Regular Audits and Compliance Reporting: The REIT must undergo regular audits and submit compliance reports to SEBI to ensure transparency and accountability[10]

By adhering to these regulations, REITs in India can provide a secure and attractive investment avenue for individuals and institutions, while promoting transparency and good governance in the real estate sector.

Taxation and Regulatory Aspects

The taxation system for Real Estate Investment Trusts (REITs) has unique implications for both business entities and investors. REITs benefit from tax breaks on revenue delivered to shareholders, which encourages them to pay out the majority of their taxable income as dividends. However, investors must pay taxes on these dividends as well as any capital gains earned on the disposal of REIT shares. Legal nuances include adhering to dividend distribution regulations and recognizing any tax exemptions.

Tax Implications:

1. Dividend Distribution: REITs must transfer at least 90% of their taxable income to unit holders, who subsequently pay taxes on the dividends received.

2. Capital Gains: Unit holders must pay capital gains tax when selling their REIT units.

3. Tax Exemptions: REITs are exempt from tax on rental income but may be subject to withholding tax on interest income.

In addition to specific REIT regulations, several broader regulatory frameworks impact their operation. These includes the Companies Act, Income Tax Act, and Foreign Exchange Regulations. Additionally, REITs must comply with SEBI Regulations, which dictate guidelines for registration, listing, and operations. They are also subject to stamp duty and registration fees on property transactions, as well as state-specific regulations related to property ownership and transfer. By understanding these taxation and regulatory aspects, REIT investors and entities can ensure compliance, minimize tax liabilities, and maximize returns.

Property Laws and REITs

Intersection with Indian Property Laws

Indian REITs must contend with a complex framework of property legislation, encompassing the Transfer of Property Act, Rent Control Laws, and land-use regulations. Compliance with these laws is crucial, as they significantly influence REITs’ capacity to acquire, lease, and manage properties. In the context of land acquisition, REITs must ensure that all transactions are legally robust and transferable, as stipulated by the Transfer of Property Act. Moreover, REITs must navigate the nuances of Rent Control Laws, which govern rental income and tenant rights, to optimize their rental yields. Furthermore, land-use regulations, including zoning laws, building codes, and environmental regulations, dictate the permissible uses and development of properties. REITs must adhere to these regulations to avoid legal and financial consequences, thereby mitigating risks and maximizing returns for their investors.

Key Legal Considerations for REIT Investors

Due Diligence and Compliance

Investors should conduct thorough due diligence to ensure that REITs comply with regulatory requirements and adhere to sound governance practices. This includes reviewing financial disclosures, understanding the REIT’s investment strategy, and evaluating its management team.

Investor Rights and Protections

Legal protections for REIT investors include rights to transparent information, equitable treatment, and avenues for redress in case of disputes. Ensuring these rights are upheld is critical for maintaining investor confidence and promoting fair market practices.

Conclusion

Real Estate Investment Trusts (REITs) have shaken up the property investment environment by providing a regulated, clear, and liquid investment option for individuals and institutions. As REITs evolve, knowing the complex legal and regulatory environment is critical for investors, developers, and stakeholders to successfully navigate this dynamic sector. By understanding the foundations of REITs, their advantages, and the legal considerations that govern their operation, investors can realize all the possibilities of this novel investment vehicle, which drives expansion, variety, and gains in the Indian real estate market.

This article is authored by Ms. Ifat Khan, student at A.K.K New Law Academy.

[1] Indian REITs Association. (2024). IRA REIT Primer. Retrieved from (https://indianreitsassociation.com/wp-content/uploads/2024/05/IRA-REIT-Primer-Website.pdf)

[2] Securities and Exchange Board of India ( https://www.sebi.gov.in/ )

[3] SEBI (Real Estate Investment Trusts) Regulations, 2014, Gazette of India, Part III, Section 4 (effective Sept. 26, 2014).

[4] SEBI (Real Estate Investment Trusts) Regulations, 2014, regs. 4-6, Schedules I-II.

[5] SEBI (Real Estate Investment Trusts) Regulations, 2014, regs. 17-20, 24-25.

[6] SEBI (Real Estate Investment Trusts) Regulations, 2014, regs. 13, 15-16, 21-22

[7] SEBI (Real Estate Investment Trusts) Regulations, 2014, reg. 7

[8] SEBI (Real Estate Investment Trusts) Regulations, 2014, reg. 8

[9] SEBI (Real Estate Investment Trusts) Regulations, 2014, reg. 9

[10] See SEBI (Real Estate Investment Trusts) Regulations, 2014, reg. 14.

All efforts are made to ensure the accuracy and correctness of the information published at Legally Flawless. However, Legally Flawless shall not be responsible for any errors caused due to oversight or otherwise. The users are advised to check the information themselves.